|

QuickBooks Accounting Integration

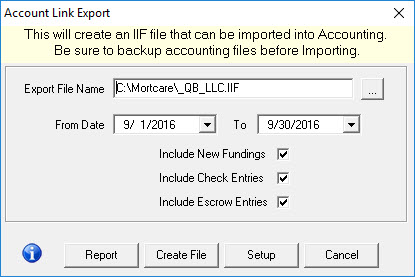

Mortgage+Care will create journal entries that can be exported to Intuit QuickBooks Pro. To access this function, go to Utilities > Accounting Link.

(This is an add-on module. If your system does not allow creating an IIF file, contact the sales department.)

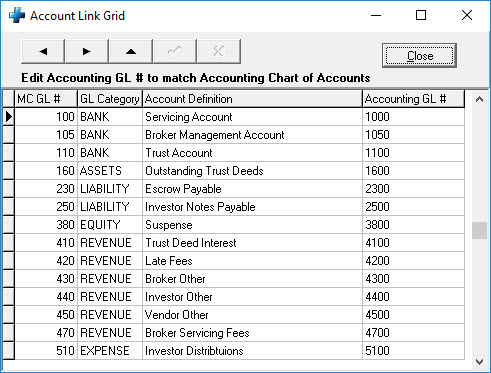

SETUP BUTTON: These are the Mortgage+Care GL Accounts that will be exported. You must enter the exact GL account number from your QuickBooks Chart of Accounts. Account names can be used, but using QuickBooks GL account numbers simplifies this process. Do not delete accounts. You can journal multiple Mortgage+Care 'buckets' into a single Quickbooks GL account.

We recommend you run this report after a check run or monthly. If a mistake is found, you can delete the journal entries in QuickBooks and re-import or correct manually.

Here are the 'T-accounts' for these entries. The reference numbers show where this data is extracted.

EVENT |

DEBIT |

CREDIT |

Monthly Payments received |

100 Assets - Servicing Bank Account (1)

|

|

| |

|

160 Assets -Trust Deeds(1)

(Principal Pay down )

230 Escrow Payable (if box checked)(1)

380 Equity - Suspense (3)

410 Revenue - Net Trust Deed Interest(1)

420 Revenue-Late Fees (1)

430 Revenue-Broker other (1)

440 Revenue-Investor other (1)

470 Income Servicing Fees (2)

|

Print Investor Checks (if box checked) |

|

100 Assets- Servicing Bank Account (2) |

|

105 Assets - Broker's Management Account(4)

230 Escrow Payable (if box checked)(2)

250 Liabilites - Notes Payable(2)

(Princiapal Pay down)

380 Equity - Suspense (3)

510 COGS - Investor Distributions (2)

(net, not including principal)

|

|

| Fund New Loan (if box checked) |

160 Assets -Trust Deeds |

|

| |

|

250 Liabilites - Notes Payable |

Actual funding check is not entered in Mortgage+Care.

Enter this manually. It is an in and out transaction if investor funded |

|

Funding or Servicing Bank Account |

| |

|

|

Where this data comes from:

1 – Borrower payment entry

2 – Check adjustments

3 – Suspense is an error trap for out-of-balance transactions. The amount should be zero

4 - Check Adjustments for BROKER

Reports to verify journal entry data:

1 - Bank Rec report receipts

2 - Bank Rec report disbursements

4 - Fees collected report

QuickBooks configuration:

Turn chart of account numbers on in Edit > Preferences > Accounting, Company Preferences Tab. Check Use account numbers.

To import the Mortgage+Care IIF file, menu to File > Import > IIF files. Select the _QB_MC.IIF file you saved. If required accounts are not found they will be created as Bank accounts. These new accounts may need to be modified.

Servicing Fees:

This utility uses accrual accounting. Servicing fees are booked when the payment is received, but paid when checks are cut.

You can either re-deposit the fee check into another business bank account, put it back in servicing, or take it as a draw. Adjust the Mortgage+Care QuickBooks account to match your business model.

Additional GL accounts you may need:

Trust Account - Bank account for closings and escrow payments

Various expense accounts (depending on your business model)

In house loans (not owned by outside investors)

If you are funding in house, do not check "Include Fundings" or "Include Check Entries". Instead book cash paid to the borrower to Assets GL account 160- Outstanding Loans.

|